- Home

- About the IAIS

- IAIS Leadership

IAIS Leadership

The IAIS delivers on its mission through a committee system made up of its members. The committee system is led by an Executive Committee (ExCo) whose 40 members come from around the world, representing advanced and developing insurance markets. The ExCo is supported by five committees established under its by-laws.

Executive Committee

The ExCo is the IAIS’ lead committee. It is responsible for providing overall strategic direction and managing IAIS affairs as specified in its by-laws. It appoints the Secretary General and takes all essential decisions for advancing the IAIS mission in accordance with the resolutions of the General Meeting of Members (which includes all IAIS members).

Toshiyuki Miyoshi

Chair, Executive Committee (Japan)

Executive Committee Chair

The Chair of the IAIS plays a key role in actively promoting the mission and activities of the IAIS in external forums and with stakeholders. The Chair:

- Is elected by the ExCo for a term of two years, which can be renewed

- Presides over both the ExCo meetings and General Meetings of Members

- Represents the views of the IAIS in discussion with other standard setters

- Chairs various groups established by the ExCo to support its duties. These groups include the Small Group on the Insurance Capital Standard, which provides recommendation to ExCo in matters related to the development of the Insurance Capital Standard and the Aggregation Method comparability assessment; the Strategic Plan and Financial Outlook Task Force, which is developing the next five-year strategic plan for 2025-2029; and the Selection Group, which is responsible for making recommendations and certain appointments of Chairs and Vice Chairs of various substructures.

Petra Hielkema

Vice Chair, Executive Committee (EIOPA)

Scott White

Vice Chair, Executive Committee (USA)

Vice Chair, Executive Committee (Morocco)

Committees

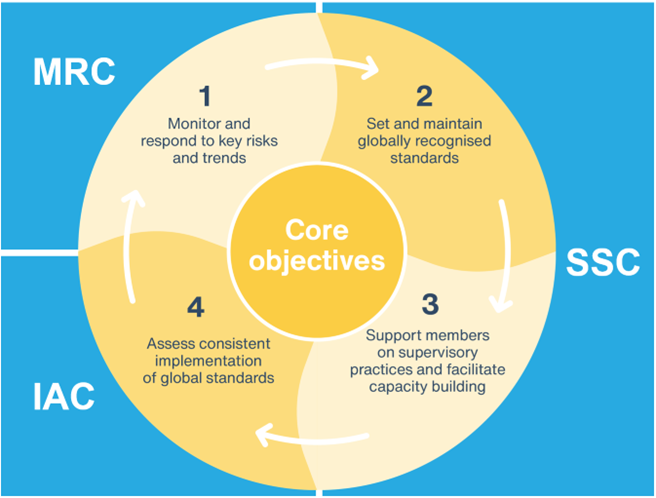

The ExCo is supported by the Audit and Risk Committee, Budget Committee, Monitoring and Risk Assessment Committee (MRC), Standards and Supervisory Practices Committee (SSC), and Implementation Assessment Committee (IAC).

Subcommittees (including working groups, task forces and forums) assist the IAIS to take forward its work programme, and they report to one or more of the MRC, SSC and IAC on a per project/activity basis as determined by the annual Roadmap.

See the IAIS committee system organigram and this graphic illustrating how the MRC, SSC and IAC advance the IAIS’ core objectives.

Suzanne Smith

Chair, Audit and Risk Committee (Australia, APRA)

Audit and Risk Committee (ARC)

The ARC is responsible for reviewing the internal controls of the Association and monitoring that its activities achieve their objectives through effective and efficient operations and are compliant with applicable procedures and resolutions.

Chair, Budget Committee (United States)

Budget Committee (BC)

The BC is responsible for overseeing the financial position and financial management of the IAIS, monitoring the IAIS’ financial situation on a regular basis, making recommendations on annual fee and expenditure levels, recommending and reviewing the IAIS’ policies on investment and reserves, and reviewing proposals for significant unbudgeted expenditures.

Dieter Hendrickx

Chair, Monitoring and Risk Assessment Committee (Belgium)

Monitoring and Risk Assessment Committee (MRC)

The MRC is responsible for monitoring and assessing developments and risks in the global insurance sector and proposing appropriate supervisory responses, which may include possible follow-up work by the other Committees. The MRC analyses issues related to financial stability, market trends, risk assessment and supervision or other related topics aligned with the IAIS mission. A key responsibility is overseeing the Global Monitoring Exercise, which is a core pillar of the Holistic Framework for the assessment and mitigation of systemic risk in the insurance sector.

Farzana Badat

Co-Chair, Standards and Supervisory Practices Committee (South Africa)

Judi French

Co-Chair, Standards and Supervisory Practices Committee (United States)

Standards and Supervisory Practices Committee (SSC)

The SSC is responsible for standard setting activity, including developing, maintaining and refining the global standards for insurance supervision. The standards are the Insurance Core Principles (ICPs) applicable to all insurers and intermediaries, and ComFrame including the Insurance Capital Standard (ICS) applicable to the supervision of internationally active insurance groups. The SSC is also responsible for supporting Members’ supervisory practices to implement the standards effectively, including through sharing good supervisory practices, enhancing understanding of supervisory issues and facilitating capacity building.

The SSC is led by two Co-Chairs, with one position specifically designated for a representative from an emerging market and developing economy (EMDE) jurisdiction.

Vicky White

Chair, Implementation Assessment Committee (United Kingdom)

Implementation Assessment Committee (IAC)

The IAC is responsible for implementation assessment activity of the IAIS standards, including the assessment methodologies, activities and reporting of outcomes. Assessments are based on a range of tools designed to cover both implementation assessments undertaken by the IAIS, and support to Members to undertake their own implementation evaluations. The IAC also oversees the accession of Members to the IAIS’ Multilateral Memorandum of Understanding.

IAIS Secretariat

Secretary General

The IAIS operates with the support of a Secretariat under the direction of a Secretary General. The IAIS Secretariat is hosted by the Bank for International Settlements (BIS) in Basel, Switzerland. The Secretariat is the point of contact for IAIS members, committees, subcommittees and stakeholders and is responsible for the day-to-day functioning of the IAIS.

More specifically, the Secretariat:

- Supports the activities of the IAIS through its committees and subcommittees

- Ensures efficient communication amongst members and stakeholders

- Maintains and reinforces compliance with IAIS policies and procedures

- Facilitates cooperation with other institutions

- Manages the financial, material and human resources of the IAIS in a proper, effective and efficient way and in accordance with the authorised budget

- Carries out all other functions assigned by the ExCo

Learn more about the IAIS Secretariat here.